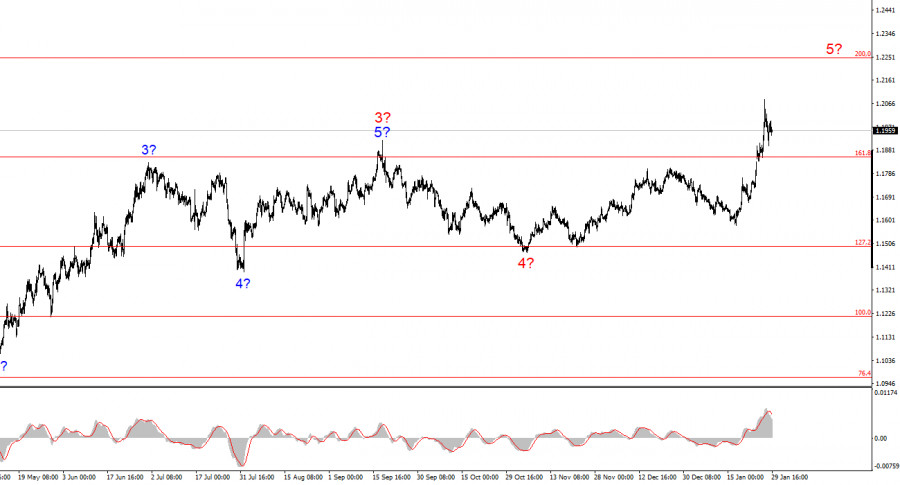

The wave count on the 4-hour chart for EUR/USD has undergone minor changes, but nothing fundamentally has changed. There is still no talk of canceling the upward segment of the trend that began in January of last year; only the internal wave structure is adjusted from time to time. It appears that the pair has completed the formation of the global corrective wave 4. If this assumption is correct, then the construction of wave 5 has already begun and is ongoing, with targets extending up to the 2.5000 level.

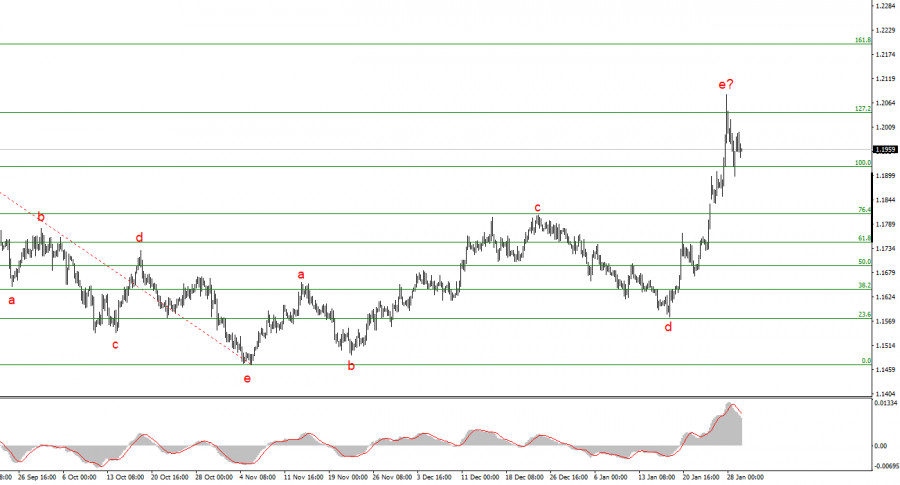

The internal wave structure of the presumed wave 5 is not entirely clear. The upward wave sequence cannot be considered impulsive due to fairly strong corrective waves. Therefore, at the moment it is interpreted as an a–b–c–d–e structure. However, if wave 5 becomes extended, its internal structure will also turn out to be quite complex. As a result, what may currently be forming is wave 3 of 3 of 5. In any case, further appreciation of the EUR/USD pair is expected, although in the coming days the market may shift to building a corrective wave—at least one.

The EUR/USD pair showed almost no change throughout Thursday, while a day earlier it lost about 90 points. This 90-point rise in the U.S. currency was not related to the FOMC meeting, as the dollar strengthened before the announcement of its results. After the FOMC meeting concluded, demand for the U.S. currency began to decline again, but overall the market found no useful or interesting information on Wednesday evening.

The dollar remains under extremely strong pressure, not even from the market itself, but from the news background. It should be recalled that just this week Donald Trump pushed relations with Canada, South Korea, and Iran to the limit. From Canada, Trump is demanding a reduction in trade with China; from South Korea, he is demanding faster ratification of a trade agreement; and from Iran, a nuclear deal. In case of noncompliance, Trump is prepared to raise tariffs on Canada to 100%, on South Korea to 25%, and to launch a missile strike against Iran similar to the one carried out last summer. And which of these events is capable of supporting the U.S. currency?

Strangely enough, wave analysis may now support the dollar. A full five-wave structure has been observed, meaning that a corrective wave or a series of corrective waves may form in the coming weeks. This correction would be the dollar's relief. However, the market is in no hurry to support the dollar and build corrections, as early as Sunday the U.S. government and many public institutions may enter another shutdown. Democrats and Republicans once again cannot agree on funding, and the previous funding package expires on January 31.

General conclusions

Based on the EUR/USD analysis, it can be concluded that the pair continues to build an upward segment of the trend. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors contributing to the long-term weakness of the U.S. dollar. The targets of the current trend segment may extend as high as the 2.5000 level. At the moment, it appears that global wave 4 has completed its formation, so further price appreciation is expected. However, a downward wave is anticipated in the near term, as the a–b–c–d–e wave sequence also appears complete. In any case, trading a correction at this time is not advisable.

On a smaller time frame, the entire upward trend segment is visible. The wave structure is not entirely standard, as the corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, such situations do occur. It should be noted that it is best to identify clear and understandable structures on charts rather than rigidly adhering to every individual wave. At present, the upward wave structure does not raise any doubts.

The main principles of this analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often imply changes.

- If there is no confidence in what is happening in the market, it is better to stay out of it.

- One hundred percent certainty about market direction does not and cannot exist. Always remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.