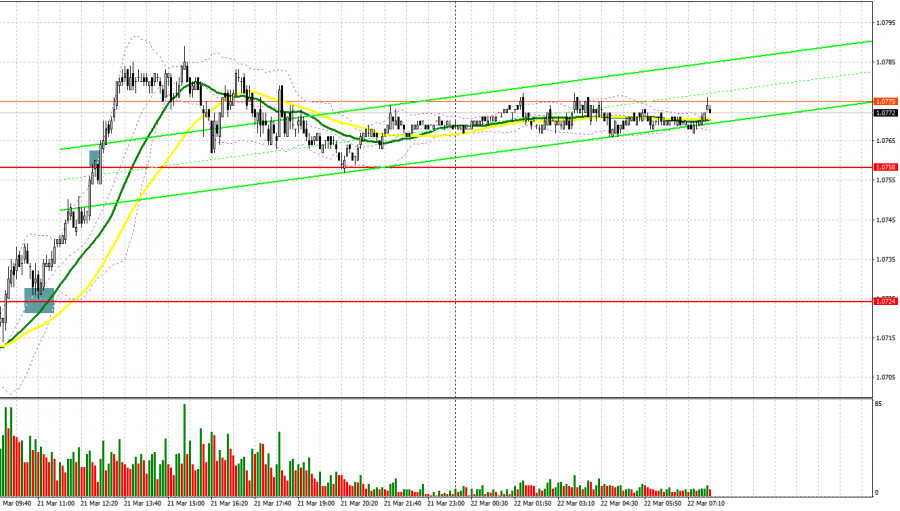

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 1.0724 to decide when to enter the market. A breakout and a downward test of 1.0724 led to a buy signal, thus allowing the pair to climb by more than 30 pips. A false breakout of 1.0758 caused a sell signal but the currency did not fall.

Conditions for opening long positions on EUR/USD:

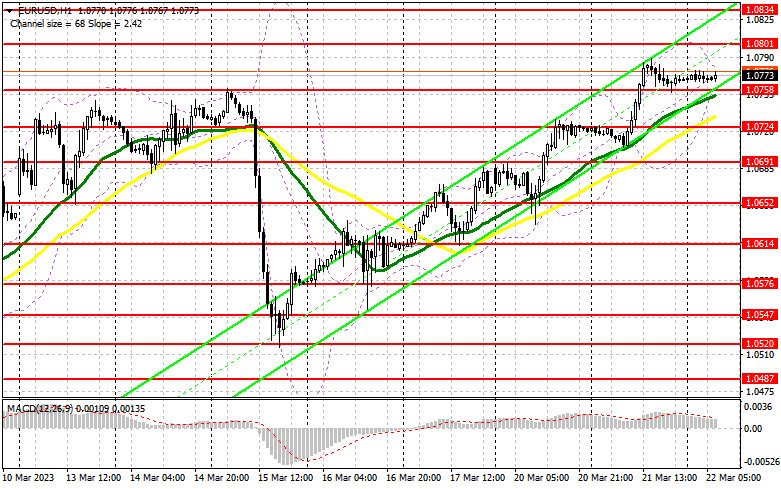

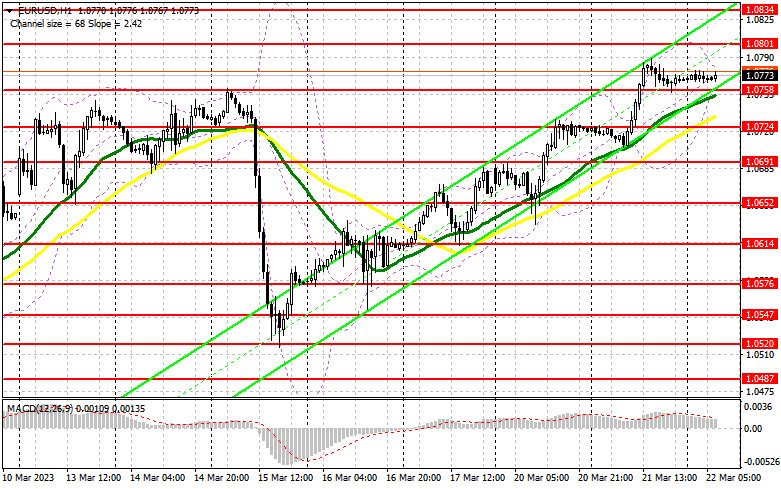

Today, everything will depend on the FOMC meeting decision. During the European session, volatility is expected to be high since Christine Lagarde, Philip Lane, and Fabio Panetta will provide speeches. The politicians are expected to support Christine Lagarde's decision to remain stuck to the current approach to the monetary policy. This may boost the euro during the European session. In case of a negative reaction to the politicians' comments and a correction ahead of the announcement of the Fed's decision, it is better to open buy orders near the support level of 1.0758. A false breakout of this level will give a buy signal with the target at 1.0801. A breakout and a downward test of this level will give an additional long signal with the target at 1.0834, where bulls may face obstacles. Meanwhile, a breakout of 1.0834 will affect bears' stop orders and intensify the bullish trend. In this case, traders will get one more buy signal with the target at 1.0873, where it is better to lock in profits. If the euro/dollar pair declines and buyers fail to protect 1.0758, where there are bullish MAs, pressure on the euro will return. A breakout of this level will cause a drop in the euro/dollar pair to the next support level of 1.0724. However, the overall market situation will remain the same. Only a false breakout of this level will form a buy signal. Traders may also go long just after a bounce off the low of 1.091 or even lower – at 1.0652, expecting a rise of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Yesterday, sellers tried to do their best. However, buyers of the euro still suppose that the Fed will loosen its monetary policy and continue to open more long positions. Now, bears should primarily protect the nearest resistance level of 1.0801, a new monthly high. The price may test this level in the first part of the day. It will be wise to open sell orders after a false breakout of this level, which may lead to a decline in the euro to the nearest support level of 1.0758. Slightly below this level, there are bullish MAs. A breakout and a reverse test of this range may cause a decline in the pair, which will form an additional sell signal with the target at 1.0724. If the price settles below this level after the comments from Christine Lagarde and her colleagues, it may slide to 1.0691, where traders should lock in profits. If the euro/dollar pair increases during the European session and bears fail to protect 1.0801, it is better to avoid selling the asset until the price touches 1.0834. There, it will be possible to sell only after an unsuccessful settlement. Traders may also go short just after a rebound from the high of 1.0873, expecting a decline of 30-35 pips.

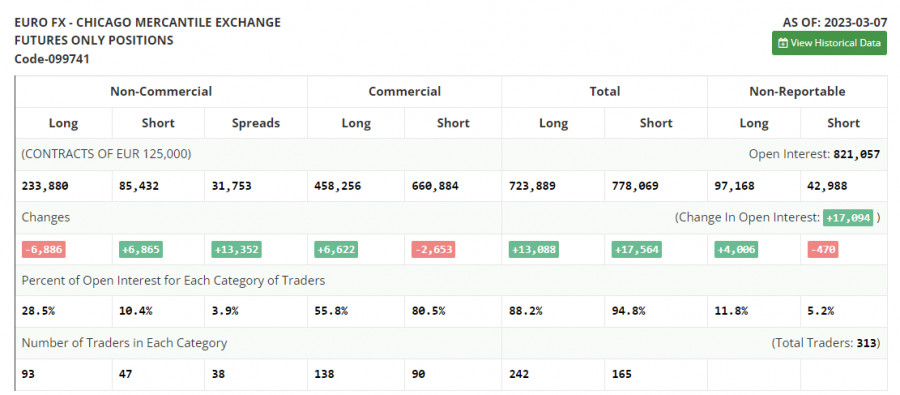

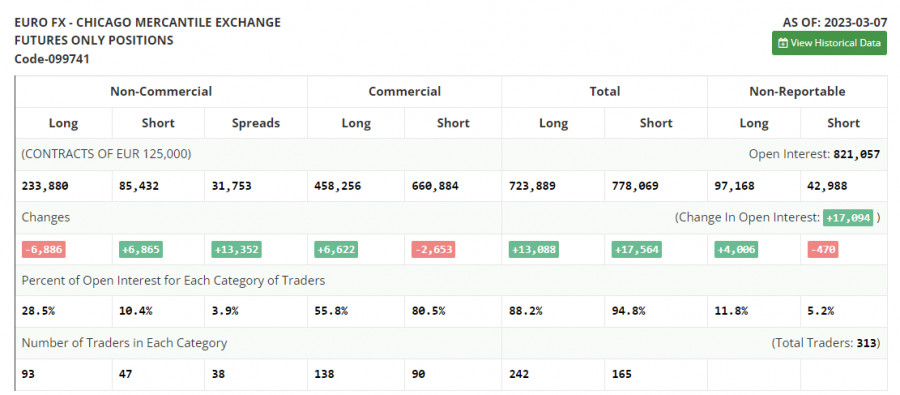

COT report

According to the COT report from March 7, the number of long positions dropped, whereas the number of short positions increased. Notably, the data is of zero importance at the moment as it was relevant two weeks ago. The CFTC is still recovering after a cyberattack. It is better to wait for new reports. This week, the Federal Reserve will hold a meeting, during which it may pause the monetary policy tightening. The fact is that the problems in the banking sector and the launch of a new credit swap line to support other banks with liquidity may seriously affect the economy. If Jerome Powell decides to raise the key rate higher, the US dollar is unlikely to receive support. Traders are pricing in the Fed's switch to a less hawkish stance and monetary policy loosening by the end of the year. The COT report unveiled that the number of long non-commercial positions dropped by 6,886 to 233,880, while the number of short non-commercial positions increased by 6,865 to 85,432. At the end of the week, the total non-commercial net position decreased to 148,448 against 165,038. The weekly closing price dropped to 1.0555 against 1.0698.

Signals of indicators:

Moving Averages

Trading is performed above the 30- and 50-day moving averages, which points to a further rise in the pair.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.0765 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.